What is Medicare?

Medicare is the U.S. national health care program that provides seniors age 65 and older, and some disabled people, with health insurance.

The U.S. government started the program in 1966. The Centers for Medicare and Medicaid Services runs these programs. Medicare also covers people with end stage renal disease and amyotrophic lateral sclerosis. (Visit the government’s website, if you want more info on these situations).

A Simple Guide to the Basics

To start, we will assume you know very little. This article breaks down the basics of our national health care system and its various parts. We will cover:

- Eligibility

- Signing-Up

- What is Provided – Parts, A, B, C & D

- Prescription Drug Coverage

- Medigap vs Med Advantage Plans

- Associated Costs

- Guides and Further Information

Who is Eligible for Medicare?

You are eligible if:

- First, you are 65 years old or older.

- Second, you have End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant) at any age

- Finally, you are classified as disabled by the Federal Government, at any age.

When do I sign-up?

If you are mentioned in the above paragraph, you might be ready to sign-up. We are going to assume that you are in the senior category for simplicity’s sake. Turning 65 is the catalyst for many people to join the program, but if you are still working and covered by an employer’s program, you may opt to defer this start date. (Just remember to tell the government if you are opting to defer.)

Open enrollment starts 3 months before your 65th birthday and ends 7 months after that start (so 3 months after your 65th birthday month). If you do not have “credible coverage,” such as an employer plan, in place after this window, you could incur penalties from the government.

How do I Sign-up for Medicare?

- First, you may be automatically signed-up if you are already receiving Social Security (SS) or Railroad Retirement (RRB).

- Second, if you are not already receiving SS or RRB benefits, you must sign up for it when you turn 65 years old.

- Conversely, if you are not ready for Medicare when you turn 65, you must notify the government that you want to delay your benefits. If you do delay, it must be because you have credible coverage in place. An example of this would be an employer plan.

Where do I Sign-Up?

- BY PHONE: If you need to sign-up for Medicare, you can call Social Security at 1-800-772-1213.

- ONLINE: Additionally, you can also visit CMS online at ssa.gov/benefits/medicare if you need to sign yourself up.

- IN PERSON: Please read our article on How to Apply for Medicare to learn about the in person sign-up process including finding a location.

- RAILROAD: Finally, if you are on Railroad Retirement Benefits, you will need to notify the local Railroad Board (RRB) office before you turn 65 that you would like to sign-up for Medicare. You can sign-up 3 months before you turn 65 even if you are not planning on retiring at 65. You can read more about Railroad requirements in our article here.

What am I getting with Original Medicare?

Original Medicare, the national health care program sponsored by the US government, provides you with two points of coverage: Part A Hospital Insurance and Part B Medical Insurance.

In addition to these two basic parts, you have to option of adding on a Part D Prescription Drug Plan. These drug plans are not administered by the Federal government, but instead by private insurance companies, and you must sign-up for them individually.

The last part is Part C or Medicare Advantage. This is a second route you can take to manage your health care that replaces Original Medicare with a “bundled” program that rolls your Parts A, B and D all into one plan. These plans (also called MA or MAPD plans) are provided by private insurance companies. We will discuss how this works more after we look at the basic parts.

Let’s look at each part:

Part A

First, Part A, also known as “Hospital Insurance,” helps with coverage regarding:

- Inpatient care

- Skill nursing facility care

- Hospice care

- Home health care

Part B

Second, there is Part B, also known as “Medical Insurance.” Part B helps with coverage related to doctor and other provider services, including:

- Outpatient

- Home health

- Doctors

- Health care providers

- Durable medical equipment

- Prevention

What Part A & B Don’t Cover

When you visit the hospital, Part A pays for most of the costs associated with these services. In addition, your doctor and medical costs will mostly be covered by Part B. However, Part A and Part B do not pay for all of it. There are co-payments, coinsurance, or deductibles that may apply to covered services.

Typically, Medicare pays for about 80% of the costs. Most beneficiaries will supplement Original Medicare with either a Medigap plan or choose a Med Advantage Plan instead. Very few people just have the Original Parts A & B alone.

Finally, there is no part that covers Long-Term Care costs such as Nursing Home or Assisted Living Expenses. Skilled nursing, yes, but nursing homes no.

Next, there is a third part called…

Prescription Drug Coverage

Part D

Finally, you need Part D, also known as “Prescription Drug Coverage.” Private insurance companies provide Part D coverage rather than the government.

Consequently, if you decide not to take on Part D coverage right away, you might incur a penalty if you try to join later. This is if you do not have “credible coverage” (such as with an employer or union). Therefore, please make sure you are signed-up for a drug plan, not just Parts A and B. This is important if you ever suspect you will need this benefit in the future.

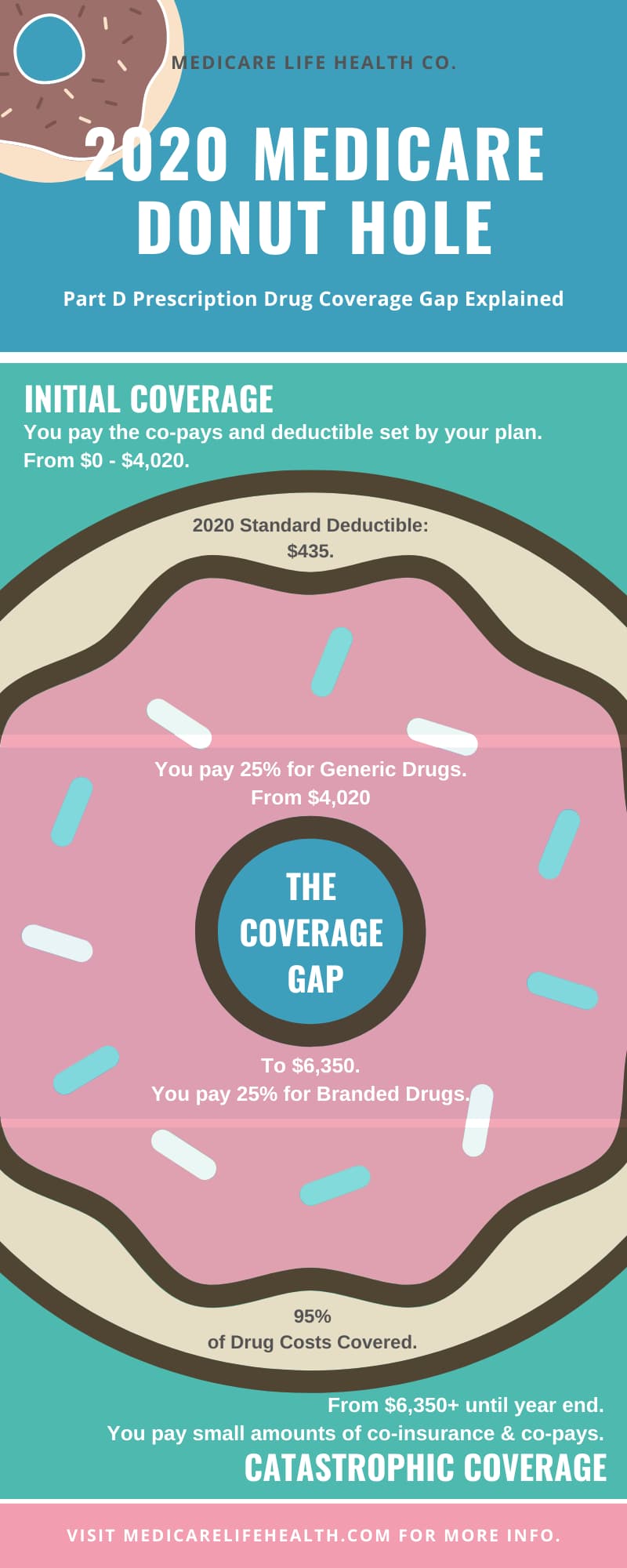

Part D plans are regulated by the US government and have many parts in common across the board, including the infamous “Donut Hole” in coverage. You can read more about that here.

The Two Paths of Coverage

You can be covered one of two ways: Original Medicare / Medicare Advantage.

Original Medicare

Path One – Enroll and keep Original Medicare Part A and Part B, sign-up for a Part D or drug plan with a private insurance company, and then you can add on top of that a Supplemental Coverage Plan that picks-up the tab where Medicare leaves off.

There are different kinds of Supplement plans (Medigap Policies) that cover different benefits and they all cost different prices with different insurance companies. To learn more about Medigap or Supplements click here.

Medicare Advantage

Path Two – After your enrollment in Parts A and B, your second option is to join a Part C plan. We call these Medicare Advantage Plans, and private insurance companies run them.

In fact, the government calls these “bundled plans.” Most of them wrap parts A, B and D all into one package. In addition, they often give their members extra benefits and hopefully lower out-of-pocket costs. To learn more about Medicare Advantage click here.

Medicare Supplements vs Medicare Advantage

Not everyone will make the same choice on what plan is best for them. Both paths are good options and have many advantages. If you would like to read about the advantages and disadvantages to both, please read this article.

What is Open Enrollment?

Also called AEP – The Annual Enrollment Period is the time of year beneficiaries can make changes to their Medicare Advantage Plans and Part D Prescription Drug Plans. Conversely, you can change your Supplement (Medigap) Insurance any time of the year.

Information for new plans starts to become available each year on or around October 1st. However, changes can not be made until AEP actually starts on October 15th. AEP then ends on December 7th each year.

How Much Does Medicare Cost?

How much you pay for your insurance depends on how you set-up your plan. As for the basics. Most people receive Part A at no cost, and everyone pays a Premium for Part B. To learn more about who pays what, please read our article here.

Part A & B Cost Summary:

- In 2020, the Medicare Part B Deductible will be $198

- In 2020, the Medicare Part B Monthly Premium will be $144.60.

Drug Costs

You will buy Part D, Prescription Coverage from a private insurance company. Each company will price their service differently. Additionally, you can shop for the best plan and price for you.

There is also an income adjustment for Part D coverage. This adjustment is on a sliding scale, and affects those that make more than $85,000 a year.

Part D also has co-pays and deductibles that raise your out-of-pocket expenses.

The Medicare and You Guidebook

Every year the Center for Medicare and Medicaid Services publish a guidebook that details out the Medicare Program: Medicare and You. In addition, this book outlines changes for the upcoming year.

The guide is helpful, but it is often way to long to capture most people attention long enough to get a full understanding of the program. For this reason, we at Medicare Life Health Co. produced a User’s Guide for the Medicare and You Guidebook, and you can find it here.

Where to find the guide

- Again, you can start with our user friendly guide here.

- Second, if you would like to download the guide for reference, you can find it online here: Medicare & You Handbook 2020

- Finally, if you need a physical copy of the Medicare and You 2020 guide, you can request one here: 1-800-MEDICARE (1-800-633-4227)

What are My Next Steps?

- Knowing which plan will be right for you circumstance is beyond Medicare 101, but you can start this journey by clicking here to read our article “Medicare Supplements vs. Medicare Advantage Plans.”

- Talking to a licensed, independent insurance agent at any stage of your planning is a good idea. Agents know your area market and can tell you what the best options are for your unique circumstances.

- If you are in NE or IA, you can contact us for more information here.

- If you are in any of our other fine states, you can find an agent here.

Further Reading

How to Dispose of Old Medications

Does Medicare Pay for Dentures

Is Acupuncture Covered by Medicare

What Does Medicare Cover?

Does Medicare Cover Chiropractic Care?

Does Medicare Cover Cataract Surgery

Medicare Part B Premium 2021 Changes

Does Medicare Cover Ambulance Services?

Best Hearing Aid Alternatives

HMO vs PPO Which is Better?

How Long Does Medicare Pay for Rehab?

Does Medicare Pay for Stem Cell Therapy?

What is MAPD?

Attained Age vs Issue Age

What is Medicare Plan G?

What are Part B Excess Charges?

How to Apply for Medicare

32 thoughts on “What is Medicare?”