Medicare Part D Prescription Drug Plan Information

Part D of Medicare covers Prescription Drugs. There are different Part D Prescription Drug Plans available. When you choose a plan you will find various costs and coverage. However, the government establishes a “standard level of coverage” that each plan must meet.

Each plan has a formulary – a list of prescription drugs – they cover. In addition, they have a tier system that ranks how much you will pay for each drug. For example, a generic drug for a specific condition might be in a lower price tier than a brand name of the same drug. You can learn more about Part D drug coverage at Medicare.gov.

Where Do I Get Part D Coverage?

You can have Part D Prescription Drug Plans by themselves (with Original Medicare Part A and Part B, but with or without a supplement) or as a part of your Medicare Advantage Plan.

What do Part D Prescription Drug Plans Cost?

Each plan will have a monthly premium (this is included in your plan premium if you have a MAPD plan). In addition, plans will also have yearly deductibles, co-payments, and costs in what is called the coverage gap. Plans will often try to help you try to save money on your drugs by offering generic options, pharmacy networks, and sometimes mail order programs.

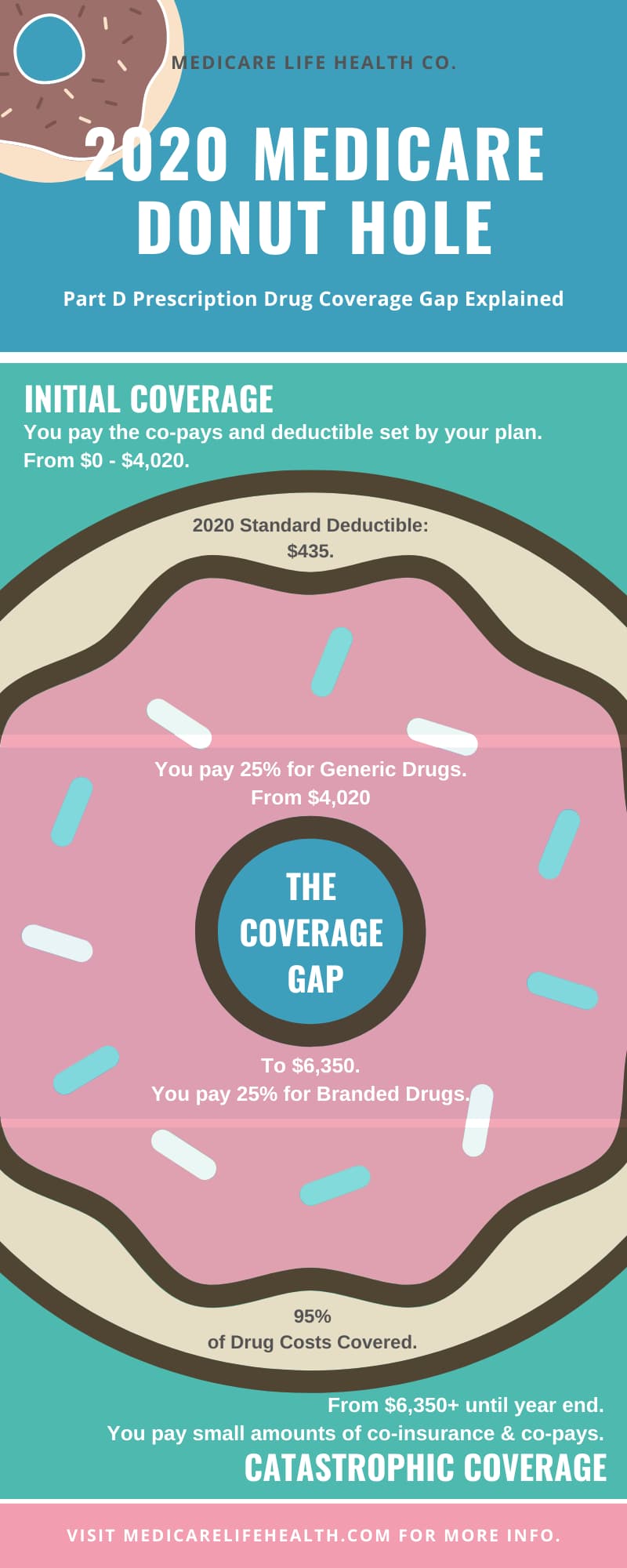

What is the Coverage Gap (aka the Donut Hole) in Part D?

In most drug plan there is a limit on what the plan will cover. In 2020, this limit was $4,020 ($3,820 in 2019).

However, once you hit $6,350 in 2020 ($5,100 in 2019) in out-of-pocket expenses in a year, you enter Catastrophic Coverage and your costs go back down to paying only small co-payments for covered drugs.

Fortunately, this “hole” in the middle of coverage has been closing-up since 2010, and by 2020, it is basically the same as initial coverage until you enter the catastrophic zone. In 2019, you pay 25% of the plan cost for covered brand name drugs and 37% of the plan cost for generics. Click here to learn more about how these costs apply to your total for entering catastrophic.

Are Medicare Part D Prescription Drug Plans Necessary?

Part D coverage is technically optional coverage. However, if you do not enroll in a plan right when you are eligible (and you don’t have any other coverage in place the government would consider creditable drug coverage), you will face fines later when signing up. Basically, if you think you will ever need drug coverage, you probably should take on a plan immediately. Penalties are calculated based on how long you are without coverage and last as long as you have Part D coverage.

How and When can I get or switch a Part D Prescription Drug Plan?

If you have both Medicare Part A and Part B, you are eligible to enroll in a Part D Prescription Drug Plan. We are always advocates of you speaking with a licensed professional before you purchase a plan or switch plans. You can review plan options online, but going over your medications and concerns with a licensed agent may save you from trouble down the road.

Your IEP, Initial Enrollment Period, for Part D is the same 7 month period when you can enroll for Medicare. This starts 3 months before you turn 65, your birthday month, and the 3 months after. Your coverage begins the first day of the month you turn 65. However, you must sign-up in time for that to happen.

Much like an MA/MAPD Plan, switching Part D plans can occur during a Special Enrollment Period. (For example, if you are moving out of a plan’s territory.) Secondly, you can sign-up each year during the Annual Enrollment Period (AEP). AEP happens yearly from October 15th to December 7th.

Other Related Topics

- What is Medicare?

- Medigap Plans (Medicare Supplement Plans)

- Medicare Advantage Plans (MA/MAPD)

- Medigap vs Medicare Advantage

- Part B Deductible

16 thoughts on “Part D Prescription Drug Plans”