Health Insurance Options in Retirement

Here at MedicareLifeHealth.com, we focus a lot on Medicare for your health insurance options. However, some people retire earlier than age 65, the age when you are first eligible for Medicare. So, then the question becomes, what are my health insurance options in retirement?

The Traditional Retirement: Age 65+

If you are a U.S. citizen, retiring at age 65 or older, then you will have access to Medicare.

What is Medicare? It is the U.S.’s national healthcare system for citizens over the age of 65, and for some people (of any age) with disabilities. We will look at Medicare as an option for health insurance in retirement at the end of this article.

Early Retirement Health Insurance Options: Under Age 65

Retiring is very exciting for most people. Retiring early? Even more exciting!

We know we need insurance. There is too much at risk without it. Chronic illness, accidents and other big health events are always a possibility as we age. However, when you are too young for receiving Medicare, insurance options can be confusing and even expensive. This is especially true if you are losing insurance that covered your family as well as yourself.

So, what are your health insurance options if you are retiring before you are eligible for Medicare?

Your Spouse’s Insurance

Your spouse may be able to cover you under their insurance if they are still working. This is definitely worth looking into, as premiums are often subsidized by their employer. Couples will often have one person work longer just for the insurance benefits in our limited health insurance market.

Employer Insurance for Health Insurance Option in Retirement

The first option for early retirement health insurance is staying on your employers insurance. However, this is not always an option offered to everyone, and even if it is, the cost can be prohibitive.

There are some businesses that offer options for retiring with insurance coverage from their group plan. As a health insurance adviser and Medicare specialist, I have seen a few of these rare health insurance in retirement plans.

Often times, these plans are offered to employees that preformed dangerous jobs – such as being a firefighter or police officer. Sometimes, other union based jobs might have more options like this available to them.

COBRA Insurance

COBRA is sometimes an option for extending employer coverage. However, it is expensive. Moreover, the time period you can stay on the plan might be shorter than you need. Often times, COBRA is only available for 18 – 36 months.

COBRA may be an option for you if:

Your employer had more than 20 employees.

You get notice from your employer that COBRA is an option for you.

With COBRA, you will be paying for your portion of the premiums in addition to what your employer use to pay for you. As a result, some people find this option to be too expensive and a prohibitive form of coverage.

Private Health Insurance

Next, you also have the option of enrolling in private health insurance. There are a limited amount of insurance companies that offer individual plans for private health insurance on the open market in each area of the United States.

Annually, the U.S. has open enrollment into these private health plans. The enrollment period is from November 1st to December 15th. However, some years (like in 2019) they extend it a few extra days. During this time, you can find a plan and get an acceptance into that plan without going through medical underwriting. These plans are not allowed to disqualify you for illnesses you already have or had in the past.

The Catch?

The big catch here is, these plans are still often very expensive, and have high deductibles. For example, when I ran a quote for myself in my area (and at my age of 36) I was quoted around $350 a month for a plan premium. Then, if I added my whole family of 4 (total) to the quote, the premiums went up to over $1,400 a month. Additionally, that plan had a deductible over $7,000, and a max out of pocket each year of $8,500. Yikes.

If you are a part of the F.I.R.E. (Financial Independence Retire Early) movement, and you plan on retiring at age 40, you will have a lot of years of high medical premiums to consider. Especially if you have dependents.

Another Health Insurance Option in Retirement: Work Part-Time for a Job with Benefits

If you find yourself in a longer time-frame, for needing health insurance before age 65, then you may consider finding a part-time job you enjoy that has health insurance benefits for part-time employees. It is not ideal for “retirement,” but it might solve your problem. Starbucks is always the go-to example for a company that provides this benefit, but you can probably find a few more options in your area.

Option Five: Opting Out of Traditional Health Insurance

I would not recommend it, but if you decide not to have full health insurance in retirement before age 65, that is technically an option too. Up until this year, the government had a fine they would levy against you if you did not have proper insurance. Now, this fine is gone. So, although you should technically have health insurance, no one is going to fine you for not having it.

If you take this option, you can find smaller policies to cover you in catastrophic events. You can find “cash” policies too. These are policies that you pay a premium for each month, and then if you have a qualifying event (such as being diagnosted with cancer), then the policy will pay you a set amount of cash. However, these plans do not pay for routine doctor’s visits or trips to urgent care, so you will need to plan to have money saved up to cover these expenses.

What About Medicaid?

We are assuming here, that if you are entering into retirement early, it is because you have saved up enough money to do so comfortably. In this case, Medicaid is not going to be an option. Medicaid is the United State’s only other option for nationalized health insurance. However, it is only available for those that live at or below the poverty level. I hope that is not you!

Now, let’s look at Medicare.

Health Insurance for Retirees Over Age 65

If you reach age 65, congratulations! Everything just got easier and better, at least health insurance-wise.

For United State’s citizens that paid taxes into Social Security and the Medicare system for their working years, you will get Medicare benefits. Most people have worked long enough in the U.S. to get Medicare Part A at no cost. Medicare Part B, does come at a monthly premium (of $144.60 in 2020).

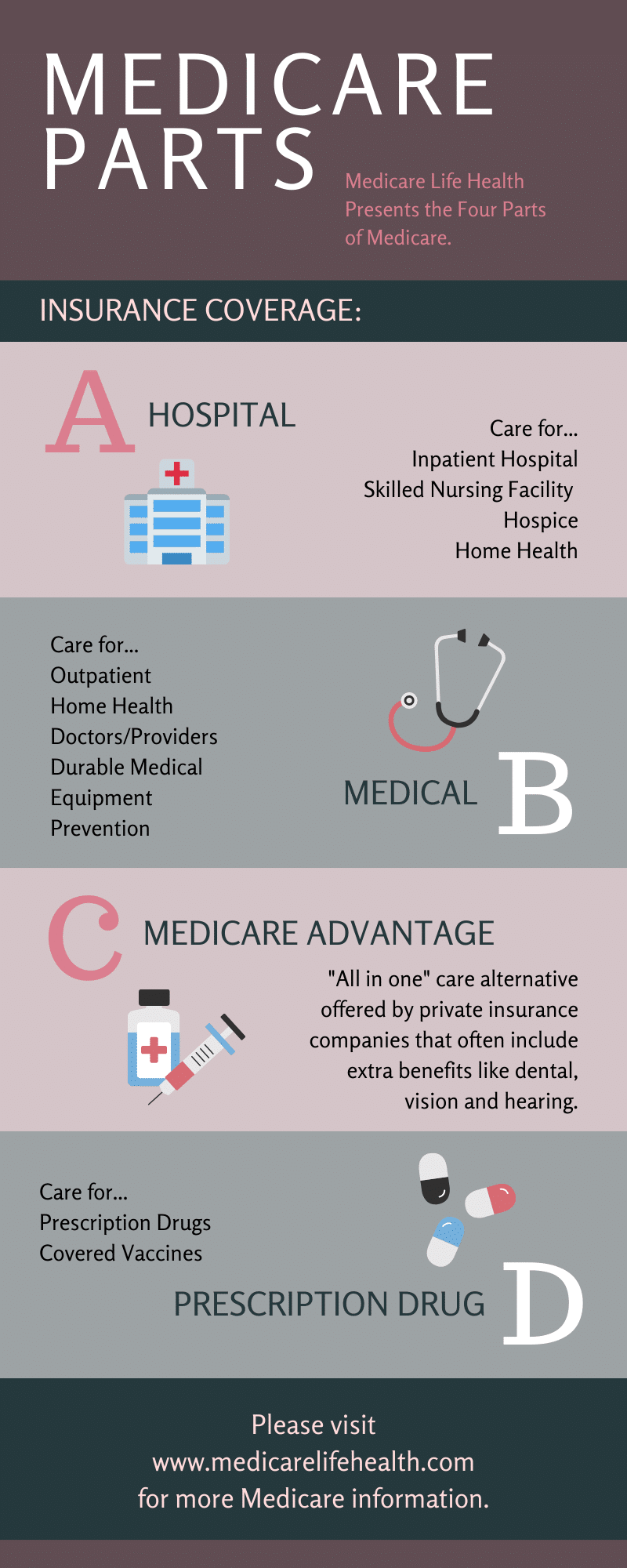

What Do the Parts of Medicare Cover?

Part A = Hospital Insurance. This covers the following:

- Inpatient care

- Skill nursing facility care

- Hospice care

- Home health care

Part B = Medical Insurance. This covers the following:

- Outpatient

- Home health

- Doctors

- Health care providers

- Durable medical equipment

- Prevention

Visit here for more information on Medicare and what it covers.

Supplemental Insurance

In total, Medicare covers about 80% of the costs of your health care needs with Parts A and B. You will need to find private health insurance coverage to cover the other 20% (or just pay it out-of-pocket). However, unlike private health insurance for those not on Medicare, your options here are pretty good!

You can either find a Medicare Supplement (Medigap) Plan or a Medicare Advantage Plan (aka Medicare Part C) to help you with these extra costs.

Click here for a good article on what these options are and what option is best for your situation.

The last part of Medicare, is Part D. This is the Prescription Drug Coverage Plan set-up by the CMS (Center for Medicare and Medicaid Services). However, these plans are actually run by private insurance companies. When ready, you will choose a plan and pay for it with those companies. If you have a Medicare Advantage program, Part D might be included as part of the plan and at no additional premium.

Conclusions

In summary, retirement health care options are easy if you are over age 65. However, if you are planning on retiring early, then you may need to get creative, or save a lot of extra cash, to cover your premiums and health care costs. Either way, it is important to always be protected and to have a good plan.